The Relationship of Organic and Direct visits to Paid Online Media

I spent the early part of my career working in brand management for Heinz and Unilever in the 1990s. We had access to scanner data, which told us the sales of a particular item or category at the store level. We had access to shipment data, which told us how much product we had shipped to a retail partner. We also knew exactly what we spent on television, radio, outdoor, and print. Unfortunately, we had no way of tying what we spent on each media type back to actual sales.

This invariably led to painful conversations at annual planning meetings where the CFO would challenge us to tie spending back to sales despite knowing there was no way we could. After our many attempts to try, ultimately, senior management always had to take on faith the fact that we were spending millions in advertising to drive millions in revenue, even if we actually had no idea which marketing programs really were returning our investment.

What drew me to online marketing was the fact that we could finally measure the exact amount of revenue generated by each online campaign. Take paid search for example. We could know exactly which keyword drove what amount of revenue and at what cost. We could match up that revenue with the spending by campaign and media type in order to finally calculate the return on investment.

But what I didn’t realize initially was that these numbers are actually vastly understated. Now, after years of managing campaigns for hundreds of small- and medium-sized consumer brands, it’s clear that typical revenue numbers reported by Google Analytics are not just understated—they’re massively understated. Why? Because Google Analytics only measures the consumer’s last click before purchase.

To put it simply, not all consumers click on an ad and buy immediately. Sometimes they come back later to buy. Sometimes they click on another ad. Often, they’re heavily influenced by retargeting ads but don’t click, and so it is more likely that they either end up doing a Google search of the brand’s name (an organic search visit) or they type website URL on their own (a direct visit).

Unless you’re a huge brand with the budget to set up impression tracking and do sophisticated attribution modeling, you can’t track consumers’ online behavior to know the actual sources of first click (the intermediate clicks leading up to the last click before purchase). You can, however—using multiple linear regression—identify a clear relationship between revenue generated by paid media and revenue generated by organic and direct conversions.

A Case Study Shows a Clear Relationship between Paid and Direct and Organic Media

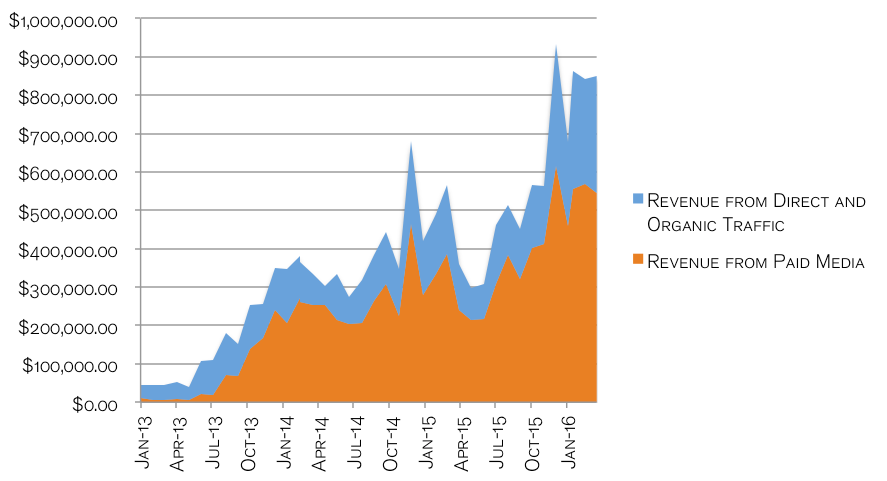

The chart below shows data for one of our retail clients over the past 3 years, tracking revenue from paid media along with revenue from direct and organic traffic. Even at a glance you can see that, as revenue from paid media goes up, revenue from direct and organic goes up as well.

By using multiple linear regression, we can actually calculate the strength of the relationship between revenue from paid media and revenue from organic and direct channels. Using 3 years of data, we calculated an r2 of 0.80751. This means that 80% of the increases or decreases in direct and organic revenue are directly attributed to the increase or decrease in revenue attributed to paid media.

If 80% of the change in direct and organic revenue can be directly attributed to changes in revenue from paid media, then it follows that we should be able to claim that 80% of the revenue from direct and organic channels was generated by paid online programs. Over a 3-year period we drove $10.1 million of direct revenue from a paid media spend of $482,000, creating an ROI of 1,900%. If we factor in 80% of the direct and organic revenue, that would be an additional $4.1 million in revenue, making for a total of $14.2 million in revenue attributed to paid online media on a spend of $482,000. This means that the actual ROI was 2,800%.

Another Client Case Study Shows an Even Stronger Relationship between Paid, Organic and Direct Revenue

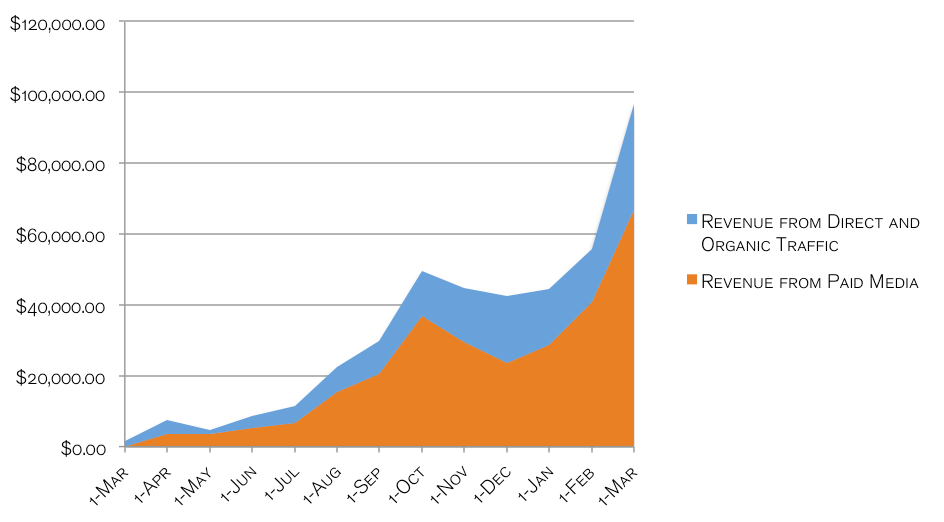

Data from another client, a start-up clothing brand, is even more compelling:

Again, we can easily see a clear visual relationship between revenue from direct and organic traffic and revenue from paid online media. In fact, multiple linear regression shows an r2 of 0.88001. In other words, 88% of the changes in revenue from direct and organic channels for the brand were actually driven by paid online media.

During this period, the brand spent $242,000 in media to drive $281,000 in revenue, creating an ROI of 16%. By factoring in 88% of the organic and direct numbers, we actually generated a total revenue of $567,000 and a positive ROI on ad spend of 134% in year 1—in a very competitive category. Needless to say, the brand is very pleased.

This is an important case because if the client hadn’t understood that most of their revenue was being driven by online programs, they might have made the mistake of cutting online spending entirely.

What Happens When a Brand Advertises in Multiple Online/Offline Channels

Notice that both of the above clients focused their marketing on online programs without spending anything on offline programs like TV, radio, outdoor, print, and PR to mud up the waters. But what about a client who spends heavily in offline channels?

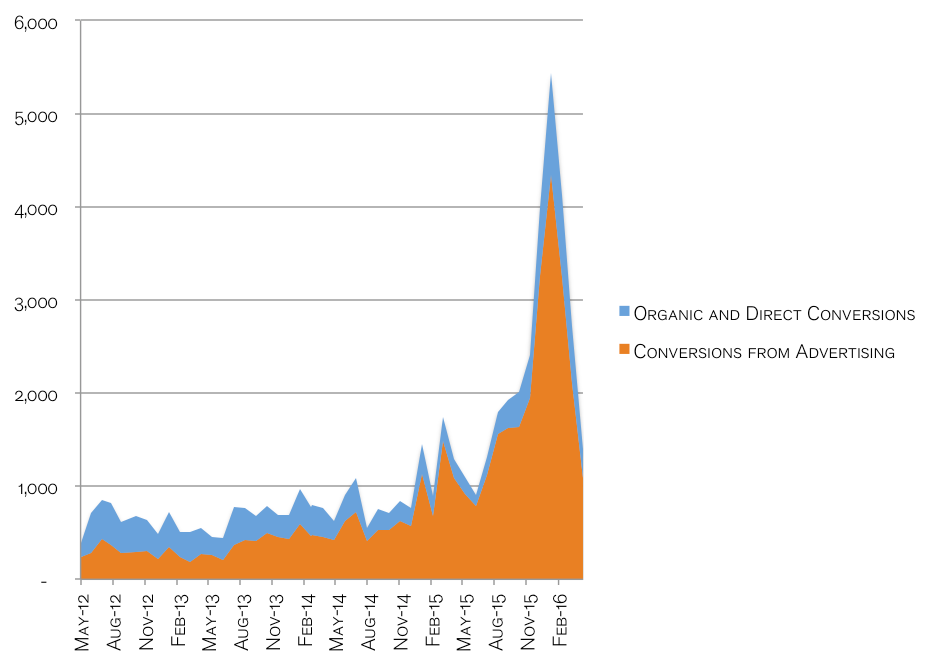

Here is an interesting case study of a client, who we’ve worked with for years, who engaged SmartClick to manage their online marketing while they were also spending millions on TV. As they saw we could deliver leads for them at a much lower cost/lead, they cut TV entirely and refocused marketing budgets exclusively on online programs.

You can see that up until early 2015, when the brand was still spending heavily on TV, conversions from organic and direct channels were actually shrinking. This was likely an effect of the rapidly decreasing effectiveness of TV with the brand’s target, women 18–30 years old, who had been defecting in droves from TV to online during this period.

When the brand cut all TV in May 2015 and channeled it into online, organic and direct conversions appear to show a much closer relationship to paid online media.

In fact, when we do a regression analysis on the data for the period with TV before May 2015, we find an r2 of 0.00081. This means there is essentially no relationship at all between advertising conversions and organic and direct conversions. The increasing inefficiency of TV was drowning out the effect of paid media on direct and organic.

However, when the brand cut all TV spending after May 2015 and devoted spending to online, we observe an r2 of 0.9573. In other words, after May 2015, over 95% of the increase in organic and direct conversions can be explained by an increase in conversions from paid online media.

The brand spent $1.1 million in online media during this period to generate 23,604 conversions from online media. If we add in 95% of the direct and organic conversions, that’s another 12,697 conversions—53% more conversions on that spend. Rather than a cost/conversion of $46, we actually drove a cost/conversion of $30 for the brand.

Why is This Important? Ad Spend Needs to Take into Account The Downstream, Residual Effect of Advertising

Case after case, analyzing past clients shows that typically 80% or more of direct and organic search revenue is directly attributable to online marketing. As a result, when deciding whether to increase, decrease or cut online marketing budgets, it’s extraordinarily important to take into account the residual effect of online advertising and the fact that consumers simply don’t usually purchase on the first click.

The full impact of online marketing spending can’t be captured in a simple report of revenue by paid online channel. If more clients understood this, they’d realize that, despite the fact that so much of what we do in online marketing can be measured, the full downstream impact of all paid online media can’t be. But at the same time, it’s clear that paid online marketing has a huge effect on channels like organic and direct visits, channels that clients typically don’t attribute to the good work of their agency.

No Comments